August 17, 2015 — With the cost of college outpacing inflation for several decades, it’s no secret that student loan debt is at a record high; yet, contrary to popular belief, student loan debt has not substantially prevented young adults from buying a home according to a recent Dartmouth – University of Wisconsin-Madison study. The downward trend in home ownership by young adults may be explained instead, by the Great Recession and the delayed transition into the social roles of adulthood, such as getting married and having children.

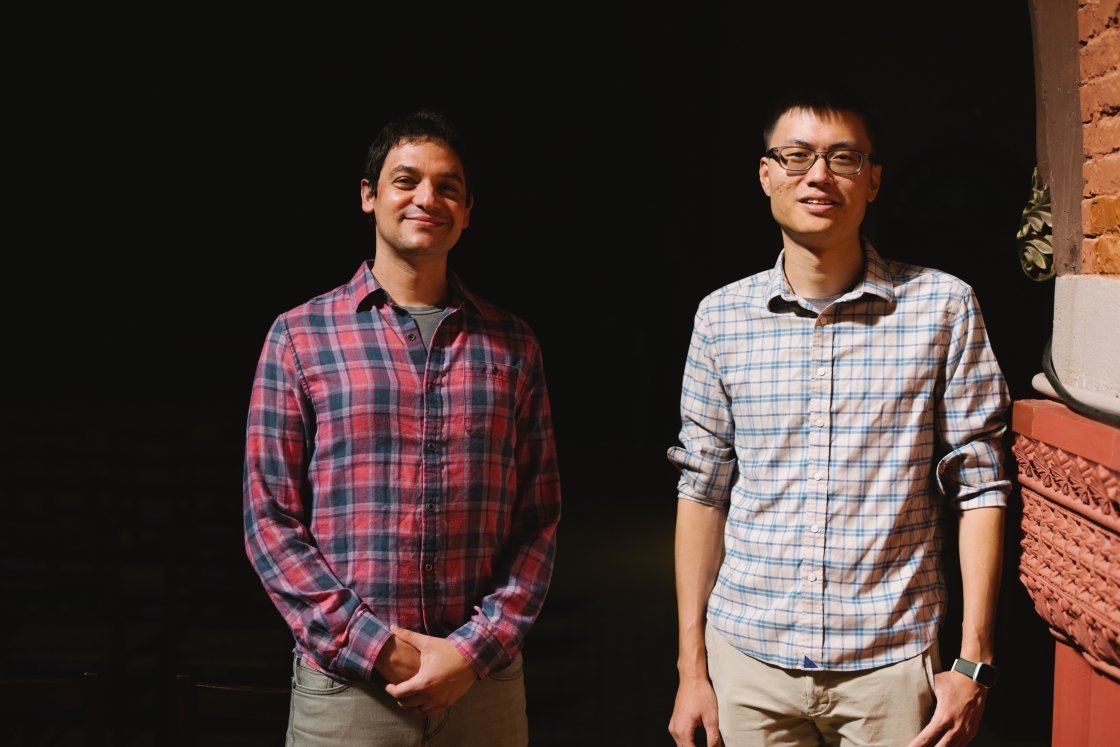

Led by Jason N. Houle, assistant professor of sociology at Dartmouth College and Lawrence M. Berger, director of the Institute for Research on Poverty and professor and doctoral program chair in the School of Social Work at the University of Wisconsin-Madison, the study’s findings were recently published by Third Way.

“The public, media and policy makers have long assumed that student loan debt is holding back the housing recovery by preventing young people from buying homes. The thought was that young people’s credit was ruined, or they simply didn’t want to take on any additional debt with their student loans. The problem is that there’s no real evidence to support these claims,” said Jason N. Houle at Dartmouth.

The media narrative regarding the slowdown of the housing market among Millennials has often focused on the rising costs of education, where young people have no other choice than to finance their postsecondary education resulting in a decline in home buying among young adults since 2006; however, these two trends may not reveal a causal relationship.

- Although the average student debtor owes $25,000, up from $13,000 or 48 percent from 1992, it is worth noting that twentysomethings today however, are more indebted than previous generations of their age with more unsecured (e.g. credit card debt) and higher debt burdens (debt-to-income and debt-to-asset ratios) than that of the Baby Boomers’ generation.

- Upon analyzing American Community Survey data, although home ownership among young adults declined as student loan debt increased during the Great Recession with home ownership by young adults under the age of 30 falling from 36.8 percent in 2006 to 32.3 percent in 2013, prior to 2005, student loan debt and home ownership were both on the rise, indicating that these two are not necessarily negatively correlated.

By examining the relationship between student loan debt and home ownership, Houle and Berger present two counter narratives: the Great Recession and the structural changes in the transition to adulthood.

- They highlight that during the Great Recession, home ownership declined dramatically among young adults due to the foreclosure crisis and a weariness to enter a down market as first-time buyers— dropping from 36 percent in 2007 to 30 percent in 2013; yet, home ownership also declined among all households from 71 percent to 67 percent during this same period.

- Young adults are spending more time completing their education and racking up more debt along the way with many are still living at home with their parents while completing their college education. As young people delay entry into “adult” roles of marriage and parenthood, they are also delaying home ownership, which tends to follow these type of transitions

With data from the National Longitudinal Survey of Youth 1997, the study found that there is a .8 percentage point reduction in the probability of home ownership associated with a $10,000 increase in student loan debt. Additional analyses revealed that this association was driven by differences between pre-existing differences between debtors and non-debtors. However, they found no evidence for a “dose-response” association between debt and home ownership. That is, someone with $5,000 in debt was equally likely to own a home than somebody with $30,000 in debt.

As such, the study found no evidence statistically supporting an association between student loan debt and mortgage amount or home equity, and thus, challenges the myth that student loan debt may be shattering young adults’ ability today to achieve the American Dream by owning a home.

Co-authors Jason Houle at jason.houle@dartmouth.edu or (814) 876-0244 and Lawrence Berger at lmberger@wisc.edu or (608) 263-6332 are available to comment.

###

Broadcast studios: Dartmouth has TV and radio studios available for interviews. For more information, visit: https://www.dartmouth.eduhttps://www.dartmouth.edu/~opa/radio-tv-studios/