HANOVER, N.H. – April 13, 2020 – A Dartmouth study finds that U.S. senators are not particularly skilled at selecting stocks, as there is no evidence that they typically leverage confidential information based on their committee assignments. As for senators’ stock sales during the coronavirus, there is only suggestive evidence. The findings are posted today in the National Bureau of Economic Research (NBER) Working Papers. (An ungated pdf of the paper is available here).

“Our study looked at about eight years of data and returns are similar to what would be expected if monkeys were picking the stocks,” explained co-author Bruce I. Sacerdote, the Richard S. Braddock 1963 Professor in Economics. “Stock picking is a very hard business for anybody, whether you’re a professional hedge fund manager or a U.S. senator, so it does not shock me at all that senators tend to get very mediocre kinds of returns,” he added.

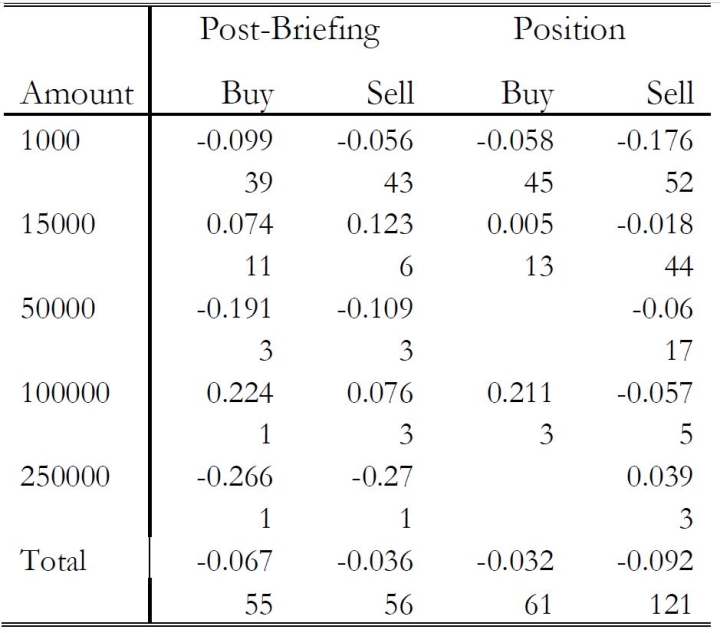

“In contrast, there’s pretty curious evidence regarding the stocks that four U.S. senators sold following the January 24 committee briefing on the public health threat of the coronavirus— trades which have been the subject of great controversy in the media,” said Sacerdote. “There were twice as many sells as there were buys after this briefing. Our findings reveal that the stocks that these senators sold, underperformed the market by 9 percent, returns that are statistically significant. These trades however, appear to be an exception to the norm, reflecting a one-off incident rather than a general pattern,” he explained. “Although it’s clear that they benefited from selling stocks ex-post, it’s not at all clear that they were selling because of private information.”

| Abnormal Returns for Trades from Dec 1, 2019 - March 27, 2020 Cells contain the average raw return minus market return and the N for the cell. |

Image  |

| (Table 8B from the paper. Table provided by William Belmont, Bruce Sacerdote and Ian Van Hoek.) |

For the study, Sacerdote and two Dartmouth undergraduate students analyzed senators’ stock trading behavior and returns based on data from 2012 to March 2020. The researchers focused on publicly listed stocks. According to the Stop Trading on Congressional Knowledge Act (STOCK Act), senators and members of Congress are required to report their stock trades either electronically or through paper filings.

The team tracked the performance of the trades from the day of the trade to nearly one year or 255 trading days forward. They examined the impact of a senator’s committee membership on the returns (i.e. whether the company for the respective stock was related to any of the Senator’s committee assignments). They also noted the Senator’s party affiliation. The trades were classified into five categories: $1,000-$9,999; $10K-49K; $50K-99K; $100K-249K; and $250K plus. Using five different benchmarks (the market, industry-size matched portfolios, value-momentum-size matched portfolios Fama French models, Carhart models), the researchers calculated abnormal returns to all stocks purchased by senators over one, three, six and12-month time periods.

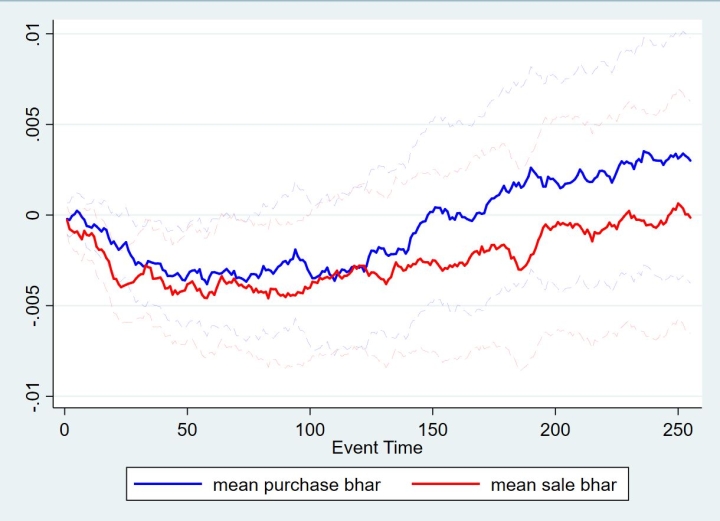

For all trades reported electronically and on paper, the buys and sells have the same pattern; they underperform slightly for the first few months and then outperform the market after 150 days by less than 1 percent, which is not statistically significant. Otherwise, the returns of the buys and sells appear to be relatively random.

| Mean Purchase and Sale Buy and Hold Abnormal Return of All Trades (Electronic and Paper Reported) |

Image  |

| The chart shows buy and hold abnormal returns from the trade date forward. Returns are the cumulative return on the stock minus an industry-size matched portfolio. The researchers match on 4 digit SIC and quintiles of market cap from six months prior to the event. Trades are from Senators 2012-2019. Buy and hold abnormal returns are the returns on the stock cumulated minus returns on the CRSP index cumulated. The researchers equal weight trades as of day 0 and do not rebalance. Missing returns for a stock are replaced with the industry-size matched return. Dashed lines show 95% confidence intervals. Chart compiled by William Belmont, Bruce Sacerdote and Ian Van Hoek. (Figure 1a from the paper). |

The results illustrate that stocks purchased by senators underperform slightly on average by 11 basis points, 28 basis points and 17 basis points at the one, three, and six-month time horizons relative to stocks in the same industry and size (market cap) categories under the industry size benchmark.

“Stocks sold by senators underperform slightly for the first three months and then outperform slightly (a statistically insignificant 14 basis points) by the one-year mark,” reports the study.

The research team had expected paper trades to outperform electronically reported stock trades, as it might be easier to hide informed trading through paper reported filings but the data demonstrated this was not the case. Abnormal returns are modest for both trade types. Electronically reported buys however, outperform at less than 1 percent after 150 days while electronically reported sells underperform modestly after the stock is sold but otherwise, returns were close to the benchmark.

As for senators’ committee memberships, there was no evidence that their returns reflected industry specific stock knowledge in relation to committee assignment(s). One such example would be if a senator was a member of the Senate’s Energy and Natural Resources Committee and was buying or selling shares in a drilling company. In fact, most of the trades do not reflect a match between company industry and committee membership, as only 6.5 percent of all trades have a match.

The results show that neither Democrat nor Republican senators are especially skilled at picking stocks to buy. Republican senators seem to fare worse both on the buys and sells.

Although there is modest evidence that market timing and stock picking may have come into play for senators’ stock trades in late January after the Senate committee briefing on COVID-19, for the most part, senators seem to have “limited stock picking prowess.”

Sacerdote is available for comment at: bruce.i.sacerdote@dartmouth.edu.